NPS Calculator

NPS Calculator

Request Callback

Request Callback

NPS Brochure

NPS Brochure

National Pension System or NPS is a Government of India initiative that aims to provide retirement benefits to all citizens (resident and non-resident) of India. It is a voluntary retirement scheme through which individuals can create a retirement corpus or old-age pension. Regulated by Pension Fund Regulatory and Development Authority (PFRDA), NPS is useful for employees, employers and for self-employed professionals.

National Pension Scheme is a Government-led initiative which is an affordable, easy to manage investment solution for all Indian citizens. The primary objective of NPS includes:

Helping people develop a regular habit of investment

Helping people develop a regular habit of investment

Providing financial stability through regular income in post-retirement

Providing financial stability through regular income in post-retirement

Offer attractive market-linked returns on investment

Offer attractive market-linked returns on investment

The National Pension System (NPS) is a defined contribution pension. NPS is voluntary for subscription by an individual to make contributions to his/her Individual Pension Account during the working life for creating a pension corpus from which regular income will be generated after retirement / working age. NPS is mandatory for the Central Government recruits w.e.f. 1st Jan 2004 (except armed forces) which replaced the earlier defined benefit pension and has been subsequently adopted by almost all State Governments for their employees.

Any Indian citizen (or NRI) aged between 18-70 years is eligible to invest in NPS.

It offers dual benefits of pension and tax saving

You can easily apply for NPS online from here

Any Individual who wants to accumulate a substantial retirement corpus over time

Any Individual who wants to accumulate a substantial retirement corpus over time

Any Individuals who do not have access to employer-sponsored retirement plans

Any Individuals who do not have access to employer-sponsored retirement plans

Any Individuals looking for a regular income after retirement

Any Individuals looking for a regular income after retirement

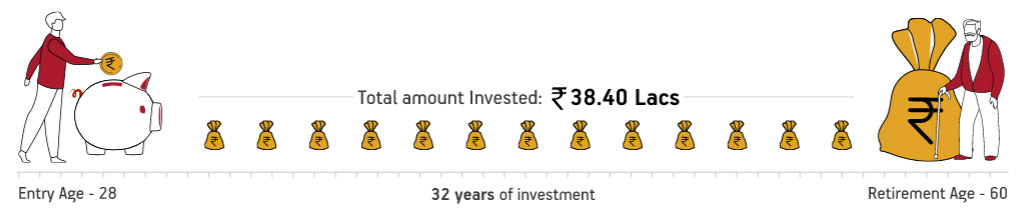

Ronit is 28 years happily married to an IT professional with a futuristic approach to life. He wishes to retire with financial independence and achieve all his life goals. He actively invested in NPS to create a corpus for his retired life and claim the tax benefits yearly.

He started contributing to NPS.Monthly investment: ₹ 10,000

Total Corpus at retirement: ₹ 2.80 CR *

*Rate of return: 10%

At 60 years of age, he gets 60% lump sum i.e ₹ 1.68 CR and 40% invested in annuity i.e ₹ 1.12 CR to receive guaranteed regular income of approx. ₹ 74,889/-** for himself & his spouse lifetime.

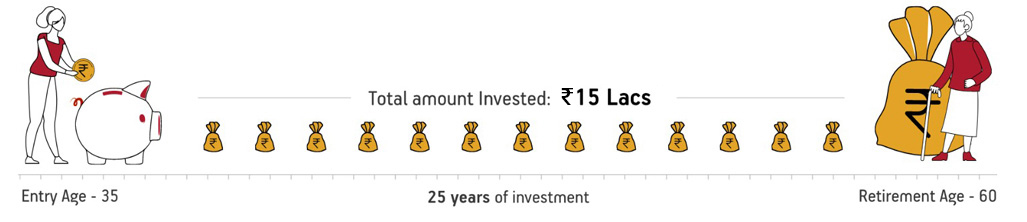

Rita is a 35-year old housewife. She takes home tuition for children in her community to keep herself occupied and be financially independent. She wishes to be financially independent ever after 60 and so decides to create a retirement corpus.

She opened a Tier I NPS account on advice of her best friend.Monthly investment: ₹ 5000

Total Corpus at retirement: ₹ 66 Lacs*

*Rate of return: 10%

At 60 years of age, she chooses to invest 100% in an annuity plan which will ensure her financial stability for lifelong with guaranteed regular income of approx. ₹ 50,000/-**.

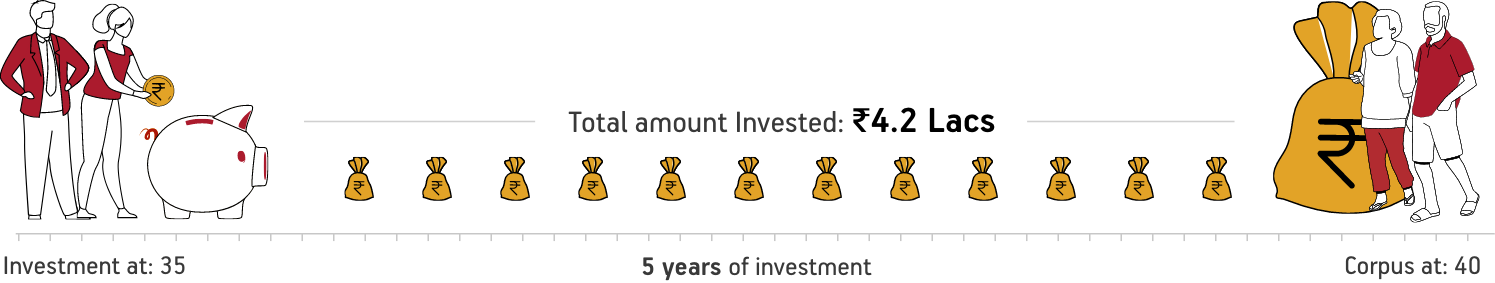

Shobhit (35) & Shreya (32) are happily married for 2 years. They both are marketing professionals and love travelling. They have set a 5-year travel goal for a Europe tour for 21 days.They are planning their investments and have decided to use NPS as an investment tool apart from retirement planning. They already have a Tier I NPS account for retirement planning.

They opened Tier II # NPS account:Monthly investment: ₹ 7000

Total Corpus at retirement: ₹ 5.46 Lacs*

*Rate of return: 10%

Tier II account provides complete Flexibility on withdrawals, 100% exposure to equity, Lower Fund allocation charges, Seamless online process.

The power of starting early is real. Understand how compounding works and use it to your advantage.

Tax Benefit

Tax Benefit

NPS contributions enjoy tax-free gains as their contribution is eligible for tax deduction under Section 80C and exempted from tax upon maturity.

Portability:

Portability:

NPS offers two types of investment options - Active Choice and Auto Choice and the subscriber can select the best option based on their investment goals and risk apetitie.

Returns

Returns

NPS subscribers can allocate their funds with a mix of equity and debt thus getting higher return than traditional retirement schemes.

Investment Choices

Investment Choices

NPS subscribers can select their investment pattern based on their risk appetite. NPS typically allows exposure to equity up to 75% under Tier 1 accounts.

Power of Compounding

Power of Compounding

NPS allows you to grow your wealth exponentially because of the long-term investment horizon.

Hassle-free online process

Hassle-free online process

NPS subscribers can open & operate their account from anywhere digitally in a hassle-free manner.