NPS Calculator

NPS Calculator

Request Callback

Request Callback

NPS Brochure

NPS Brochure

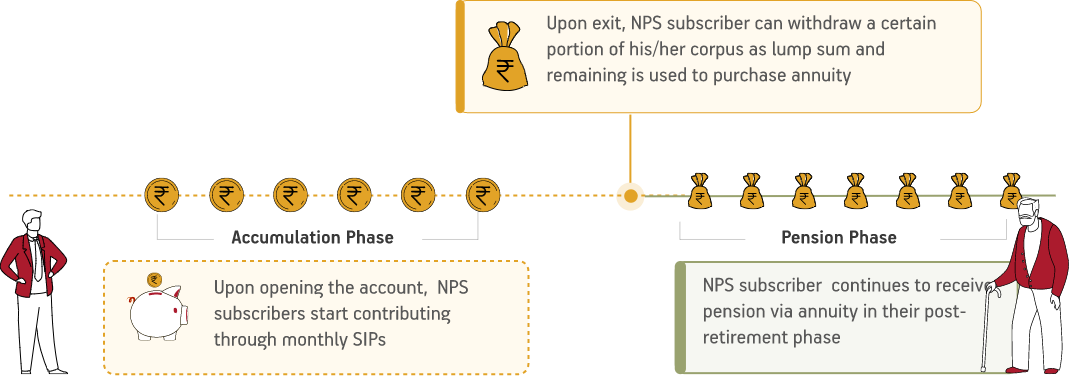

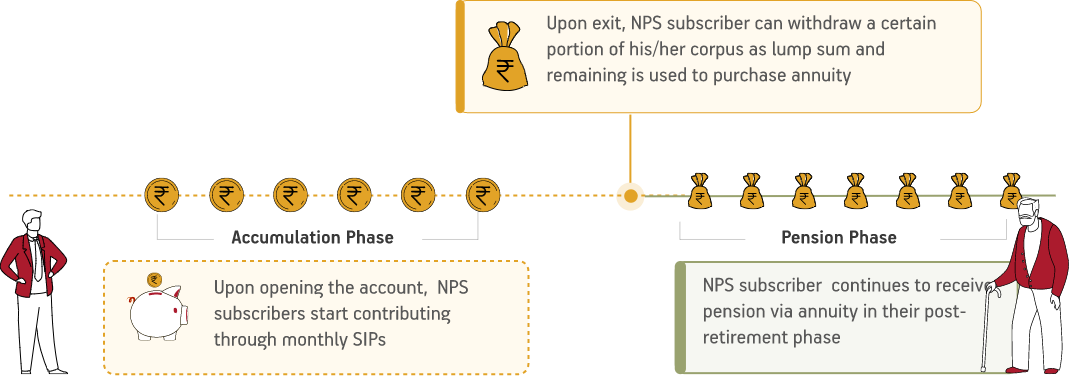

Any individual (non Government and non Corporate) who wish to invest to NPS can contribute towards their retirement fund through Retail NPS model. (All Citizen Indian Model). The scheme, which is regulated by the PFRDA (Pension Fund Regulatory And Development Authority) is a voluntary, defined contribution retirement savings scheme that helps individuals earn pension post retirement.

All Indian citizens, including NRIs and OCI

Subscribers must be between 18-70 years at the time of registration

Must comply with the KYC requirements

For detailed eligibility criteria - click here

All Indian citizens, including NRIs and OCI

Subscribers must be between 18-70 years at the time of registration

Must comply with the KYC requirements

For detailed eligibility criteria - click here

STEP 1

STEP 1  STEP 2

STEP 2  STEP 3

STEP 3  STEP 4

STEP 4  STEP 1

STEP 1

It is a tax-efficient pension scheme (Tax benefit under Section 80 CCCD(1) and Section 80CCCD(1B) of Income Tax Act 1961)

Offers additional

tax benefits

Provides market-linked returns

Well-regulated and

low risk

Easy to contribute funds online

Enjoy power of

compounding

To know more benefits of retail NPS- Click here .

The National Pension System (NPS) is a defined contribution pension. NPS is voluntary for subscription by an individual to make contributions to his/her Individual Pension Account during the working life for creating a pension corpus from which regular income will be generated after retirement / working age. NPS is mandatory for the Central Government recruits w.e.f. 1st Jan 2004 (except armed forces) which replaced the earlier defined benefit pension and has been subsequently adopted by almost all State Governments for their employees.

Any indian citizen(or NRI) Aged between 18 - 70 yrs is eligible to invest in NPS