NPS Calculator

NPS Calculator

Request Callback

Request Callback

NPS Brochure

NPS Brochure

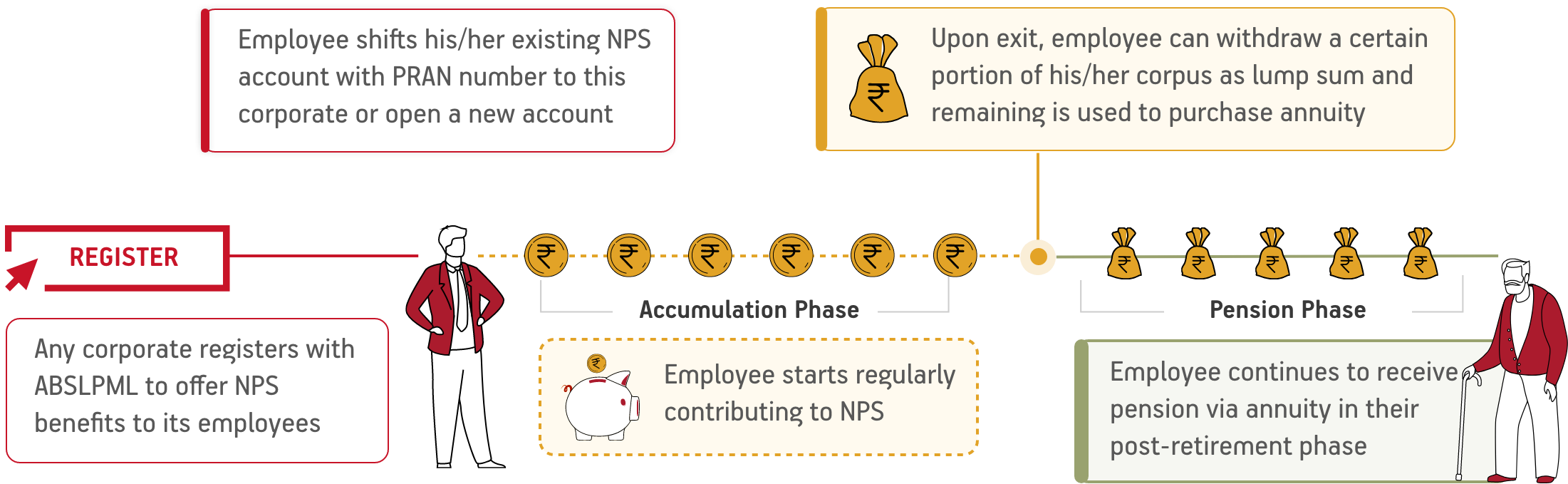

Corporate NPS is available to organised sector employees working in organisations registered under the Corporate NPS Model. Launched in December 2011, Corporate NPS is regulated by PFRDA. It is a voluntary contribution scheme where periodic contributions are made by the employer on behalf of the employee to the employee’s NPS account. Employees of both public and private sectors companies can choose to join NPS under the corporate model.

Indian employees (Resident Indian / NRI / OCI) of a corporate entity which has implemented NPS in the organization.

The subscriber should be between 18 to 70 years on the date of opening the NPS account

Compliant with KYC norms

Indian employees (Resident Indian / NRI / OCI) of a corporate entity which has implemented NPS in the organization.

The subscriber should be between 18 to 70 years on the date of opening the NPS account

Compliant with KYC norms

Offers tax benefits to employee and employer

Seamless portability across jobs and geographies

Flexibility to choose their investment options

Helps employees build a larger retirement corpus.

100% digital process for account opening and contribution

The National Pension System (NPS) is a defined contribution pension. NPS is voluntary for subscription by an individual to make contributions to his/her Individual Pension Account during the working life for creating a pension corpus from which regular income will be generated after retirement / working age. NPS is mandatory for the Central Government recruits w.e.f. 1st Jan 2004 (except armed forces) which replaced the earlier defined benefit pension and has been subsequently adopted by almost all State Governments for their employees.

Any indian citizen(or NRI) Aged between 18 - 70 yrs is eligible to invest in NPS